The IRS recently provided notice of when they would start processing individual income tax returns for the 2020 tax-year: February 12, 2021. While this may seem a lot later than most years, this is only a ~2 week delay compared to 2020’s filing season as it started on January 27, 2020. Also keep in mind that while the IRS will not start processing these returns until February 12th, you can prepare and submit your tax returns whether that is through self-prep software or a tax preparer so when filing season starts in earnest you can be ready to file immediately.

The IRS anticipates individuals claiming refunds should receive these within 21 days, with some special exceptions for those individuals claiming the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC). This delay in accepting and processing returns with these credits is to hopefully minimize refunds being issued for fraudulently filed returns.

As you begin putting together your 2020 tax documentation don’t forget to include any unemployment income you may have received in 2020. This should be reported to you on form 1099-G by the state or jurisdiction that paid you. You should expect to receive this form no later than February 1st. If you paid any subcontractors in 2020 that need a 1099-NEC or 1099-MISC be sure that these are issued no later than February 1st as well.

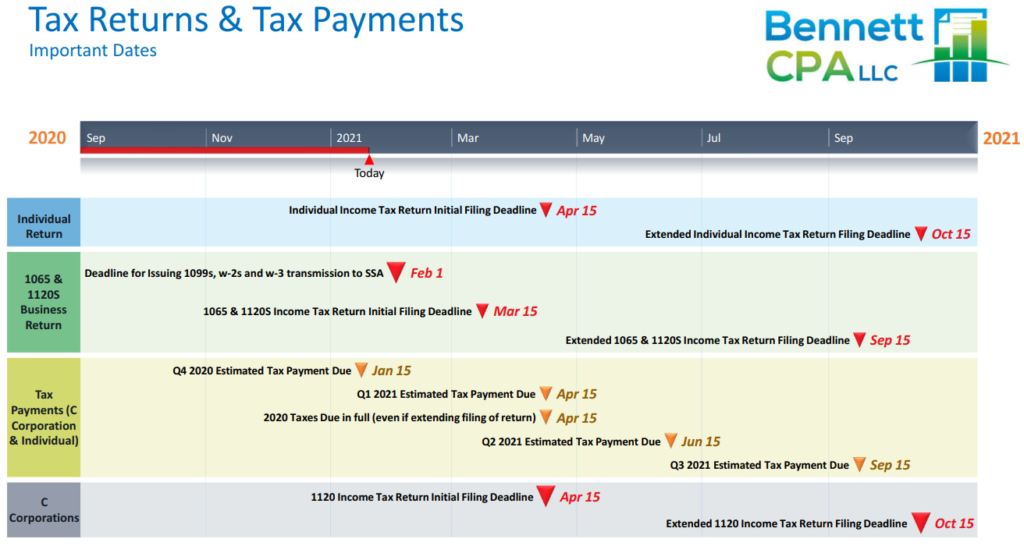

All other dates for filing, estimated tax payments and extended filing deadlines remain similar to prior years for the time being (see chart below):