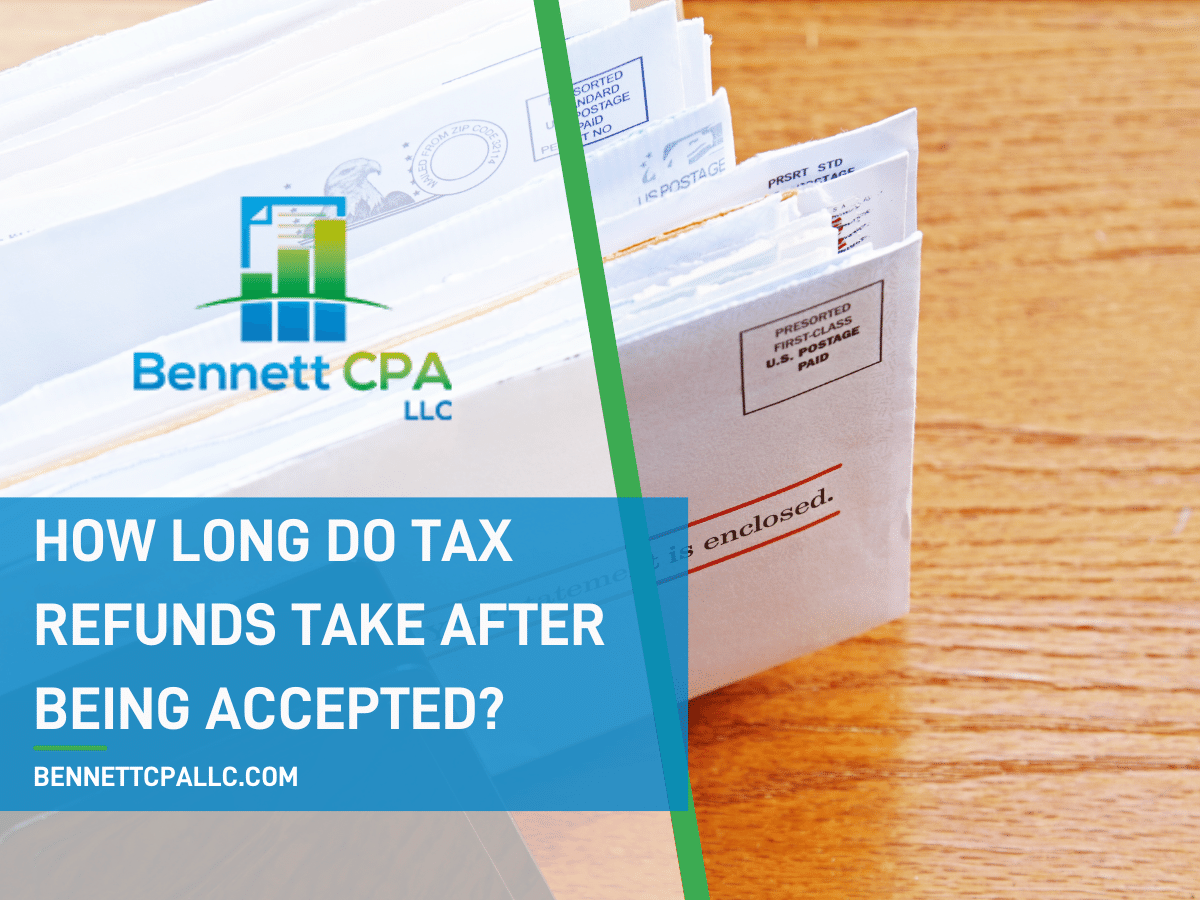

Tax season is stressful. However, if you are getting a refund back, you may be looking forward to filing your taxes. Each year, one of the very first questions you have after filing your taxes is, “how long do tax refunds take after being accepted?” The Internal Revenue Service, or IRS, says taxpayers usually get their refunds within 21 days of filing. However, the answer to this question is not so simple. To answer the question, “how long do tax refunds take to process?”, take a look at some of the factors that will impact how long it takes for you to get your tax refund back.

At Bennett CPA, Merrill Bennett is on a mission to provide affordable, accessible, and quality tax services in Colorado Springs and beyond. From individual tax preparation to business tax planning, Merrill Bennett provides customized tax solutions. At Bennett CPA, you will receive comprehensive tax planning, tax preparation, and tax consulting services aimed at helping save you as much time and money as possible. You do not have to navigate the complexities of taxes yourself. As a certified public accountant, Merrill Bennett is here to offer you tax support so you can always stay on top of your taxes. Bennett CPA is your trusted tax partner for individual and small business tax services.

If you want to know more about the timing of tax refunds, keep reading to learn how long your refund can take to process!

The IRS Refund Timeline

Tax refunds are typically issued in less than 21 days according to the IRS. However, you can experience delays with your tax refund depending on your filing method and the types of tax breaks you claim. Here is the expected IRS refund timeline by filing and tax refund method:

Tax Filing Method and Tax Refund Method

- E-file > Direct deposit > Less than 21 days

- E-file > Paper check > About 4 weeks

- Mail > Direct deposit > About 3 weeks

- Mail > Paper check > 6-8 weeks

When Will My Tax Refund Be Direct Deposited?

When you file your taxes, the IRS has to verify that the financial information you file is accurate. As long as your taxes are correct, most taxpayers receive their refund in less than 21 days if they e-file and set up their refund for direct deposit.

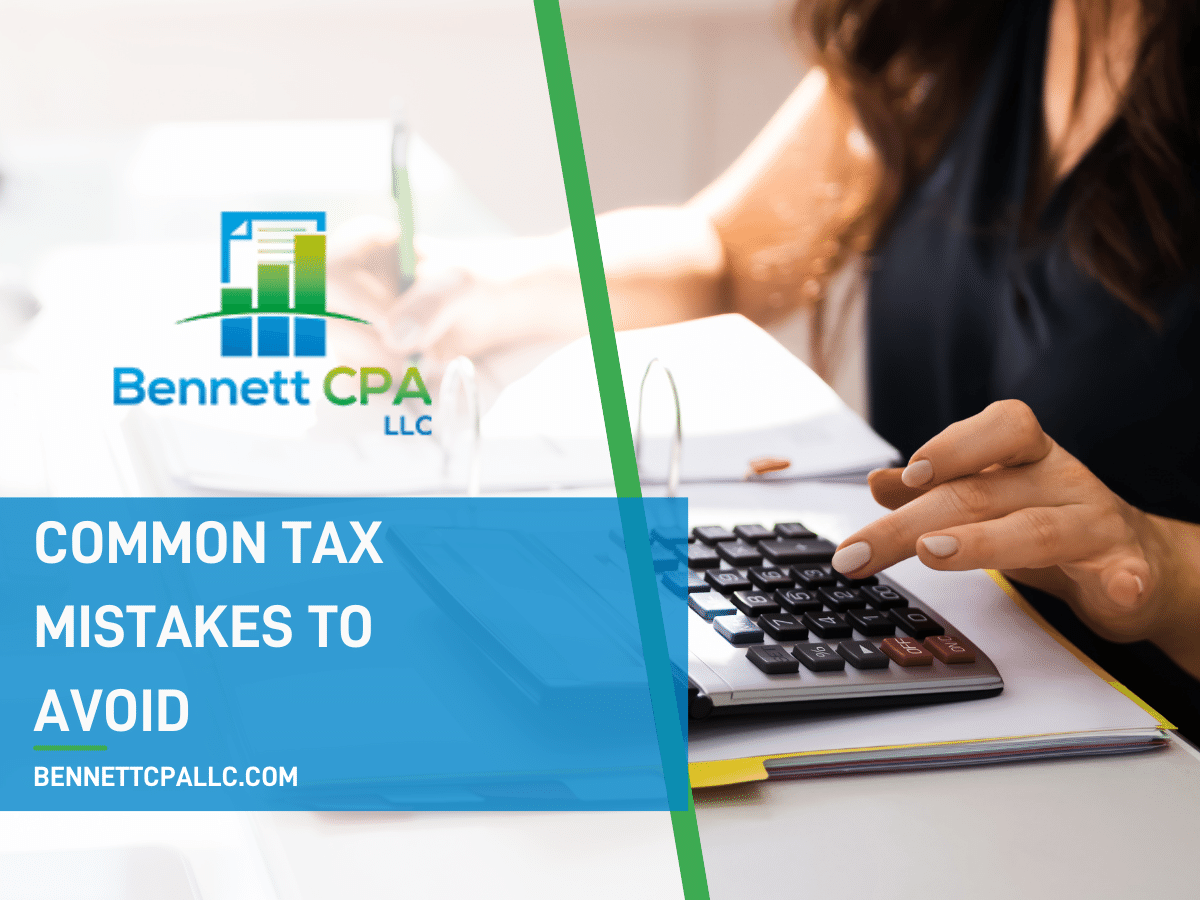

However, you can experience tax refund delays if your taxes are inaccurate. If the IRS requires more information from you in order to process your taxes, this will result in a tax refund delay. This is why it is crucial that you double-check the information on your tax return. Additionally, your tax refund may be delayed if it needs to be corrected or reviewed further.

Some credits, such as the Earned Income Tax Credit and the Additional Child Tax Credit, can slow down your direct deposit. Other information, like Form 8379, or Injured Spouse Allocation, can slow down the processing time on your taxes, too.

To check the status of your refund, the IRS has a “Where’s My Refund” tool. If you are considering contacting the IRS about the status of your refund, you should call the IRS if:

- It has been 21 days since e-filing

- It has been more than 6 weeks since mailing your tax return

- The “Where’s My Refund” tool says to contact the IRS for further information

When Will My Tax Refund Be Mailed?

According to the IRS tax refund timeline, paper check refunds can take 6-8 weeks to process. However, you may experience delays in your refund if the IRS takes longer to process your paper return.

The IRS works on a first-come, first-served basis, which means that they will process earlier tax returns first. This can cause your paper tax return to be delayed in processing. Therefore, your refund will be delayed, too. Especially with tax processing slowdowns with the COVID-19 pandemic, the IRS is still processing 2021 tax returns.

Individuals that mailed in their tax returns can also use the IRS’ “Where’s My Refund” tool. If you have waited more than 6 weeks for your refund since filing your return, you can also get in touch with the IRS.

If you would like to avoid tax refund delays in the future, e-filing your taxes and setting up a direct deposit is the fastest way to get your refund!

File Your Taxes Right the First Time With Bennett CPA

Tax season can be overwhelming. Not only is the process of filing your taxes confusing, but it is long and tedious, too! Once you file your taxes, you may also be wondering how long it will take to receive your tax refund. While the IRS says less than 21 days, the length of time it takes to process your refund depends on many factors. For example, how you file your taxes, what credits you claim, and the refund method you select. Plus, if you make a mistake on your tax return or the IRS needs more information from you, this can delay your tax refund even more. This is why filing your taxes right the first time is the best way to ensure you get your refund as quickly as possible.

At Bennett CPA, Merrill Bennett is here to provide Colorado Springs and surrounding areas with the best tax preparation services. From tax planning, preparation, and consulting, Merrill Bennett will work with you to set you up for tax season success! With personalized tax services from Bennett CPA, you can have peace of mind that your taxes are being filed accurately and on time. Merrill Bennett will work with you to plan your tax strategy and maximize your tax refund so you can take control of your financial future. If you have any questions about tax services from Bennett CPA, contact Merrill Bennett today!