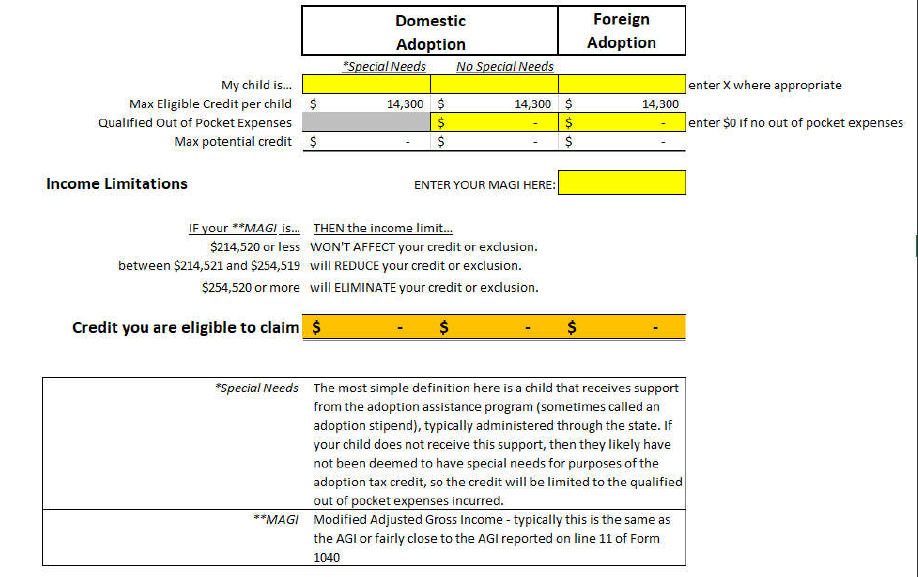

The adoption tax credit in 2020 is up to $14,300 – depending on your specific circumstances – for a child whose adoption is finalized in 2020. So the question is ‘Can I claim this adoption tax credit’ and ‘What qualifies me for claiming this credit’?

As with most accounting and tax questions, the answer is ‘It depends on your specific circumstances’. The adoption tax credit falls into two categories – domestic and foreign adoptions – with a subcategory under domestic adoptions for those deemed as ‘special needs’. The definition of ‘special needs’ for purposes of the adoption tax credit can be boiled down to whether or not the child receives support through the adoption assistance program (sometimes called an adoption stipend). If the child does not receive this support then the credit will be limited to the qualified adoption expenses incurred.

The North American Council on Adoptable Children (NACAC) has additional information and a more detailed description of scenarios and who qualifies that can be accessed HERE.

For those adopting out of the foster system that will be receiving ongoing adoption assistance payments, this credit is often overlooked as little to no expenses have been incurred. As the child has been deemed special needs you are eligible to claim the full adoption credit (though this will only be refundable to the extent taxes were paid in, carrying forward up to 5 years or until fully utilized, whichever comes first).

You can access a the adoption tax credit Form 8839 on the Helpful Documents page or email me directly for a quick excel calculator. If you have any questions related to claiming this credit or if you may qualify you can email these questions to bennettcpallc@gmail.com.